February 17, 2022

October 26, 2022

‘Money printer go brrr’ was the meme of 2021, a video of J Powell physically printing money wildly.

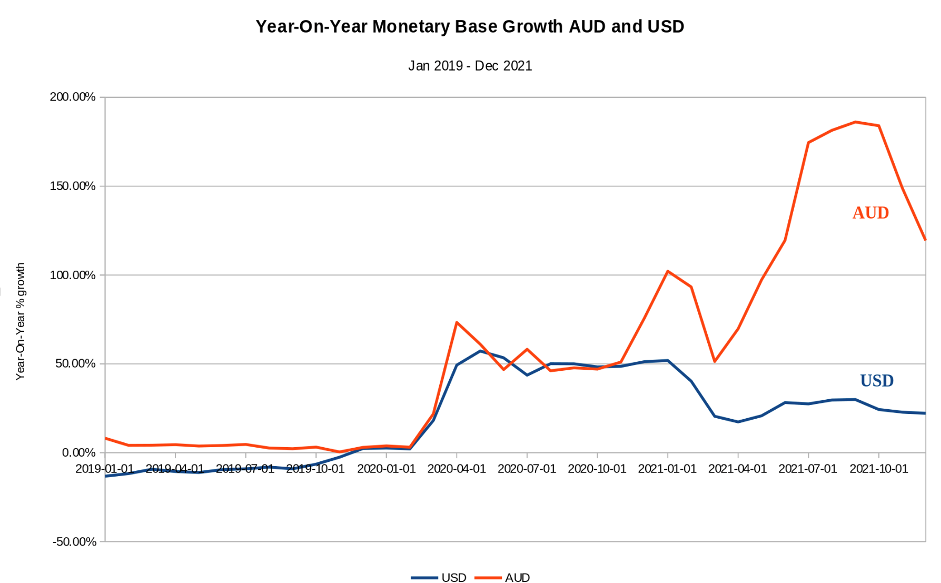

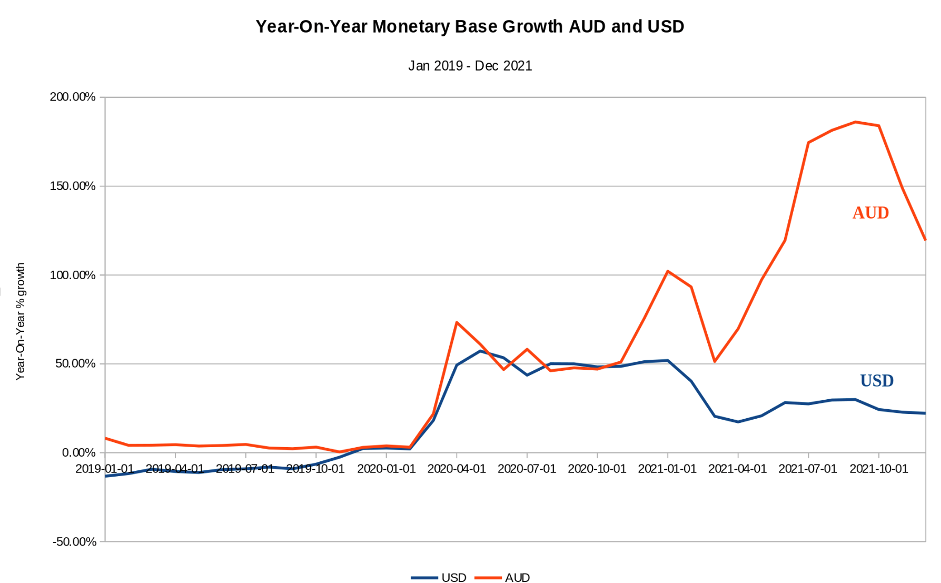

The Reserve Bank of Australia (RBA) was frantically printing as well, actually even much more than the Federal Reserve!

For 2021, the USD year-on-year growth of the monetary base was 22%, compared to the AUD’s monetary base growth of 120% (source; source)

This raises the question, if the inflation measuring index, the Consumer Price Index (CPI), in the United States is 7.5% for the last 12 months, why is CPI in Australia only 3.5%? shouldn’t Australia’s CPI be higher?

Here’s what happens

When the RBA prints money, they are actually buying government bonds from the banks of Australia. This new supply of money from the RBA is recorded as the monetary base.Banks can either leverage up their new supply of cash (lending it out to borrowers for houses etc) or hold onto the cash as a buffer to protect the bank from possible bad loans caused by crises such as the GFC or COVID.

When banks lend out the money to borrowers, they leverage the new cash.

If the banks receive $100 million from the RBA, and their fractional reserve is 10%, they can potentially lend out $1,000 million. Essentially creating $900 million out of thin air.

This ‘new money’ is recorded at M1.

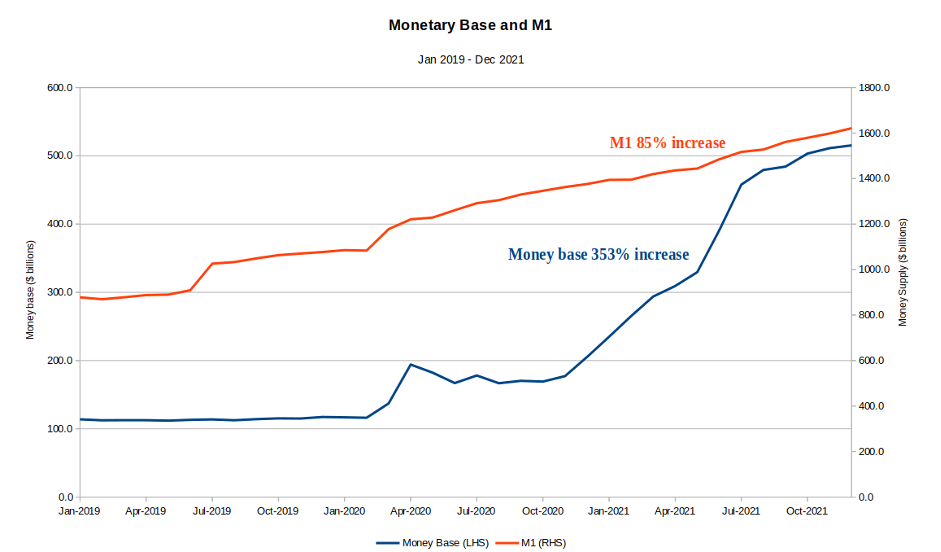

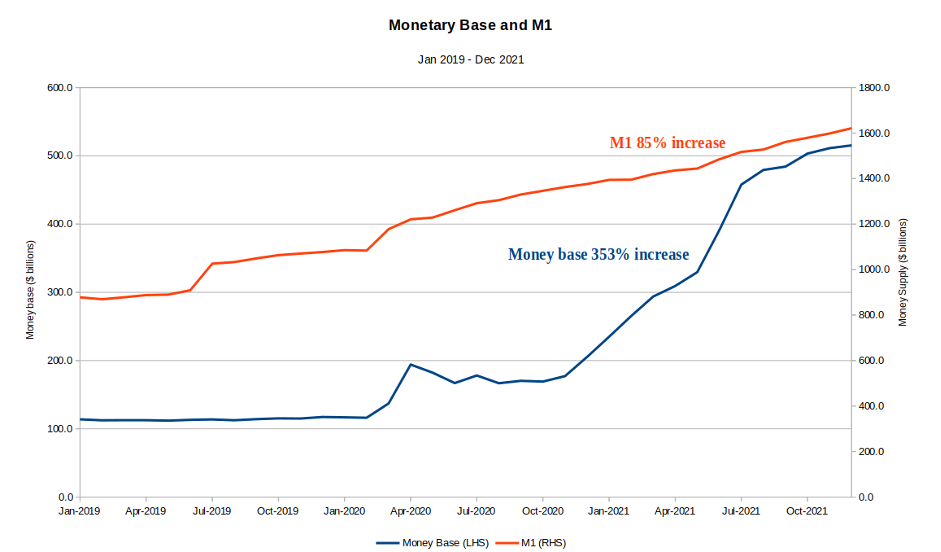

From Jan 2019 to Dec 2022, M1 only increased by 85% compared to a money base increase of 353%, meaning the Australian banks were holding onto the majority of new money as a buffer against bad loans, instead of lending it out to borrowers (source).

The RBA has now stopped buying bonds from the banks, and the ball is in the banks’ court. Inflation may increase further if the banks lend out this new money to borrowers, as banks can leverage their cash supplies.

Alternatively, the RBA could place downward pressure on inflation by buying back money from the banks, achieved by selling government bonds to the banks.

It will be interesting to see how much M1 increases over the next 12 months.

Bitcoiners consider Bitcoin an inflation hedge with a known and enforced monetary policy which is why I’m buying more.